IDC x AC

This is an exclusive column featuring expert analysts from International Data Corporation (IDC)who provide insights into the latest products, news, and more.

In the global smartphone market, where Android dominates over 80% share with flashy spec-filled smartphones that fold and scream AI features, it is not easy to stand out. However, anyone who’s played poker knows it’s not always the best hand that wins. Strategy, timing, and knowing when to go all-in often matter more than the cards themselves. Apple’s September event at Apple Park was, at first glance, a showcase of a strong hand: sleek devices, bold design, and carefully crafted messaging.

But the real game runs deeper. The iPhone 17 Air and Pro lineup may be Apple’s “pocket aces,” but they aren’t enough on their own to drive the next wave of growth, which is Apple’s ultimate endgame. Apple’s real bet lies in three calculated moves: disciplined pricing, design-driven differentiation, and aggressive trade-in incentives. While most Android players focus on price wars and long spec sheets, Apple is counting on these three strategic moves to make the aces matter and ‘win the hand’ — fuel a massive upgrade cycle in the year ahead.

Bet 1: Design-driven product differentiation

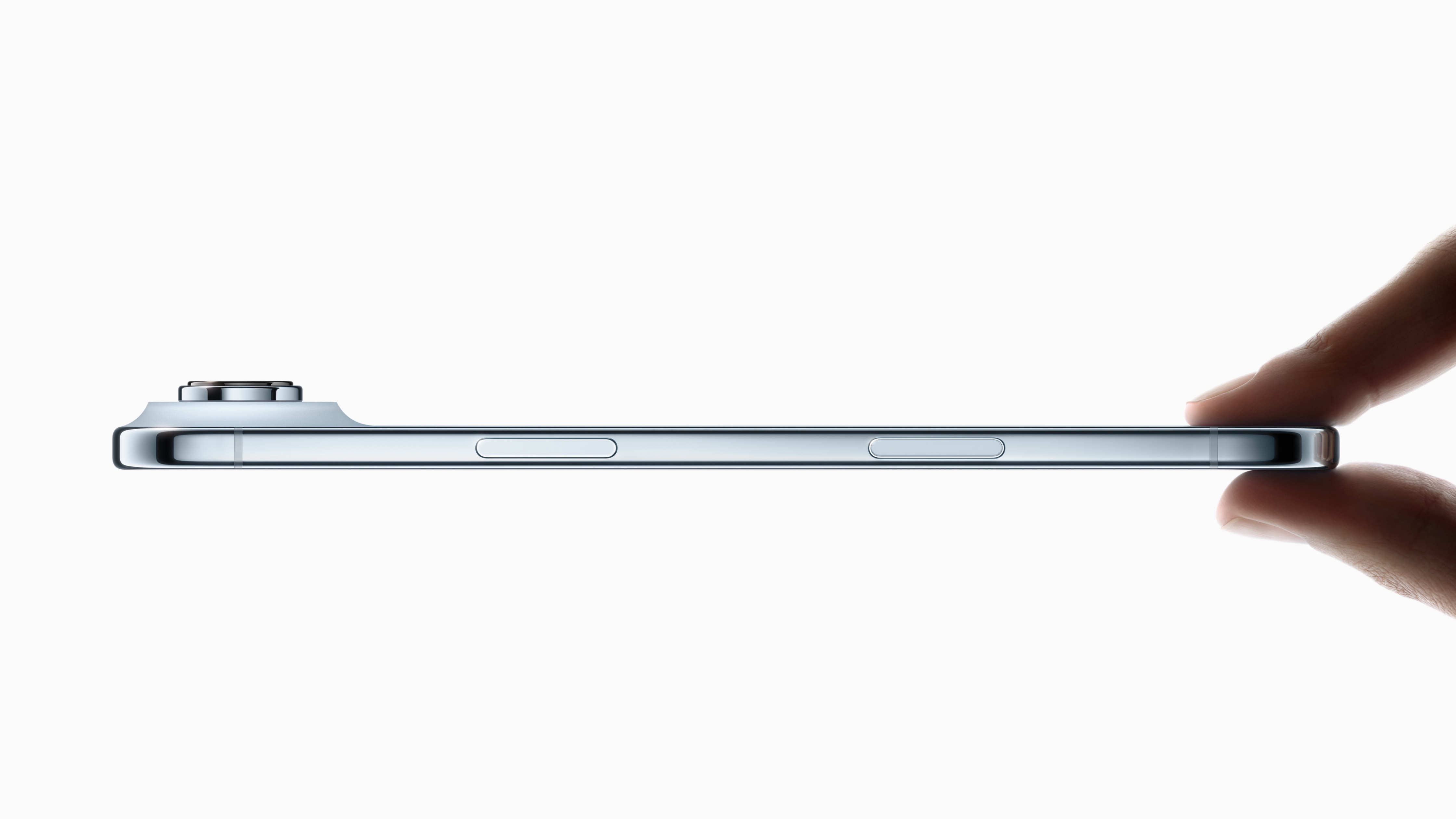

The Air — Style Icon: Apple knows design sells, and the iPhone Air is built to turn heads. Slim, lightweight, and instantly recognizable, it appeals to consumers who value aesthetics over maxed-out performance. At 5.6mm, it is slimmer than the 5.7mm Samsung Galaxy S25 Edge and $100 cheaper.

What impressed me most was how incredibly light it felt. “It feels like Air,” I said, a sentiment echoed across Steve Jobs Theater. That weightlessness will attract consumers tired of bulky phones but still wanting a premium product.

Strategically, the Air sits neatly between the entry-level iPhone and the Pro line — a tier the Plus model failed to establish, contributing at best just 7% of Apple’s global shipments. I expect the Air to succeed here, potentially driving 15% of volume despite the much-talked-about compromises and regulatory challenges in China. In a market where differentiation is key, a novel design balanced with the right price and performance can be a powerful trigger.

The Pro Lineup — Performance Icon: The iPhone 17 Pro models are positioned to focus on performance, offering longer battery life, faster processing, and advanced cameras for content creators and enthusiasts willing to pay top dollar for the highest specifications. The return to aluminum was another power move — leaving Android rivals puzzled after they just shifted to titanium to mimic Apple’s recent success.

Beyond lower cost, better heat management, and durability, aluminum also enables bold colors like Cosmic Orange, already going viral. Apple places a heavy bet on design in its power lineup, placing confidence that upgrades are often emotional decisions, and design — especially color — plays a big role.

The iPhone 17 — Value Icon: Apple also gave significant upgrades to its base model, trickling previously exclusive “pro-only” features into the entry-level iPhone 17, boosting its appeal to value-conscious consumers and already triggering record-breaking pre-orders. This reflects Apple’s new approach: rather than size or price-based differentiation, it leans on design, style, and performance, sprinkling novelty and premium features throughout the lineup. The result is a more consistent premium feel throughout, at nearly the same price as last year.

Bet 2: Restrained pricing strategy

This restraint sends a clear message to its consumers: Apple won’t add pressure to already-stretched wallets. That promise matters more than any spec sheet in today’s inflationary climate, and it will help sustain Apple’s momentum in emerging markets where long-term growth rests.

Apple is able to lean into its scale, vertical integration, and supply chain control to make this strategy work without hurting profitability, a play most Android rivals can’t match. While competitors struggle with shrinking margins and price wars, Apple is cementing its 40% value share of the smartphone market and 70% share of the premium ($1,000+) segment.

Bet 3: The upgrades engine

All of this feeds into Apple’s endgame: driving a massive upgrade cycle. The Air serves as a style icon, the Pro models target heavy users, and the baseline 17 offers strong value. Stable pricing lowers upgrade friction and reinforces value, while aggressive trade-ins (up to $1,100 in the US) make upgrading a “no-brainer.” Early preorder data suggests the strategy is already working.

To top it off, over 430 million iPhones shipped in 2020–2021 are now hitting the 4–5-year mark — the typical upgrade window for iOS users per IDC. No matter what model they bought then, the iPhone 17 lineup gives them a compelling reason to trade up.

The final hand

For Android OEMs, this is a learning opportunity. While many Android phones chase spec sheets or pricing wars, Apple is playing a bigger game, a global upgrade strategy. Its mix of design differentiation, price restraint, and ecosystem lock-in pulls users forward, even when rivals match or exceed specs.

Apple’s event may not have delivered the slimmest phone in the smartphone world or the loudest AI when you stack it against Android counterparts, but its real play is subtle and powerful: the sum of design, pricing, and trade-in incentives. Every detail nudges users off older devices, lowers upgrade friction, and reignites growth in a slowing market.

Upgrades are the endgame, and Apple has gone all in.